Medicare in Kentucky

Original Medicare, Medicare Advantage, Part D prescription drug, and Medigap coverage in Kentucky

Medicare enrollment in Kentucky

As of August 2024, there were 986,495 people enrolled in Medicare in Kentucky.1 That’s about 17.8% of the state’s total population, compared with about 17.7% of the United States population covered by Medicare.2

Medicare eligibility depends mostly on age, but some beneficiaries are eligible because of a disability. About 84% of Kentucky’s Medicare population is eligible due to age (ie, being at least 65), while the other 16% (about 161,000 people) are eligible due to a disability (including ALS or ends-stage renal disease).1 Nationwide, only about 11% of Medicare beneficiaries are eligible due to a disability.3

Learn about Medicare plan options in Kentucky by contacting a licensed agent.

Explore our other comprehensive guides to coverage in Kentucky

The ACA Marketplace allows individuals and families to shop for and enroll in ACA-compliant health insurance plans. Subsidies may be available based on household income to help lower costs.

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Kentucky.

Learn about Kentucky’s Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Kentucky.

Frequently asked questions about Medicare in Kentucky

What is Medicare Advantage?

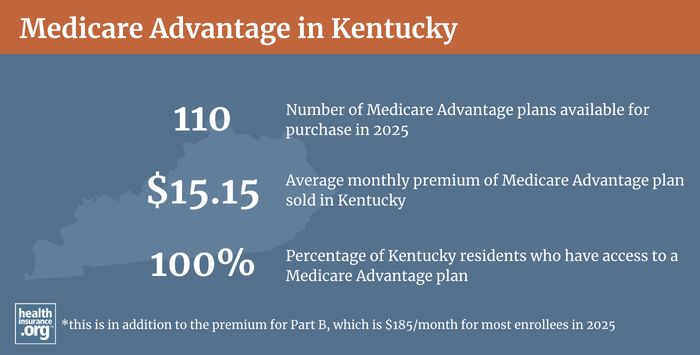

About 54% of Kentucky Medicare beneficiaries were enrolled in private Medicare Advantage plans as of August 2024, which was a little higher than the national average of roughly 50%.13 Medicare Advantage enrollment in Kentucky has been increasing in recent years, in line with national trends.

The rest of the state’s Medicare beneficiaries have opted instead for coverage under Original Medicare, which is Medicare Part A and Part B, administered directly by the United States government.

Medicare Advantage plans provide all of the benefits of Original Medicare, including hospital and outpatient/physician care (but the out-of-pocket costs can vary considerably from what they’d be under Original Medicare). Most Advantage plans also include Medicare Part D coverage for prescription drugs, and many include extra programs like gym memberships, nurse hotlines, and coverage for dental and vision services. But provider networks tend to be more limited with Advantage plans, and out-of-pocket costs vary from one plan to another. There are pros and cons to either option, and different solutions work for different people.

Medicare Advantage plans are offered by private health insurers that have varying service areas, so plan availability varies from one part of the state to another. In most counties in Kentucky, there are more than 30 plans available for 2024.4 But plan availability in Kentucky is much more uniform than we see in many other states, where the discrepancy between rural and urban areas is often much more significant.

The annual open enrollment period in the fall (October 15 to December 7) allows beneficiaries to switch their Medicare Advantage enrollment from one plan to another, or to change from Medicare Advantage to Original Medicare or vice versa. There is also a Medicare Advantage open enrollment period (January 1 to March 31) during which people who are already enrolled in Medicare Advantage plans can switch to a different Medicare Advantage plan or drop their Medicare Advantage enrollment and receive coverage through Original Medicare instead.

What are Medigap plans?

Medigap plans are used to supplement Original Medicare, covering some or all of the out-of-pocket medical costs (for coinsurance and deductibles) that people would otherwise incur if they only had Original Medicare on its own. Original Medicare does not have an upper cap on out-of-pocket costs, which makes supplemental healthcare coverage particularly important. More than half of Medicare beneficiaries nationwide have supplemental coverage through Medicaid or an employer-sponsored plan, but Medigap provides important protections for those who must purchase their own supplemental healthcare coverage.

In Kentucky for 2025, there are 40 insurers offering Medigap plans. And as of 2022, according to an AHIP analysis, there were 219,513 Kentucky residents enrolled in Medigap plans.5

Medigap plans are standardized under federal rules, and people are granted a six-month window, when they turn 65 and enroll in Original Medicare, during which coverage is guaranteed issue for Medigap plans.

But federal rules do not guarantee access to a Medigap plan if you’re under 65 and eligible for Medicare as a result of a disability. Two-thirds of the states have adopted rules to ensure at least some access to Medigap plans for disabled enrollees, and Kentucky will join them starting in 2024, due to legislation the state enacted in 2023.

For now, the state’s Medicare supplement guide notes that insurers can use medical underwriting when an applicant is under age 65, even if they apply during the first six months after enrolling in Medicare. But H.B.345, which was signed into law in April 2023, will change that, starting in 2024. The legislation:

- Requires Kentucky Medigap insurers to offer guaranteed issue coverage to Medicare beneficiaries under age 65 who submit an application within the first six months after their Medicare begins. And the insurers will not be allowed to charge these applicants premiums higher than the weighted average rates that apply to people age 65 and older.

- Creates a “birthday rule” in Kentucky, which will allow a person with Medigap to switch to another insurer’s Medigap plan (same letter as the plan they already have) within 60 days of their birthday, on a guaranteed-issue basis.

For now (before 2024), Medicare.gov’s plan finder tool shows numerous Medigap plans available to a person under age 65 in Kentucky, particularly for Plan A, F, and G (in other states where the state doesn’t have rules to require this, availability of Medigap plans for people under age 65 tends to be very limited, with perhaps only one or two insurers voluntarily offering plans). But the Kentucky Department of Insurance confirmed that the state’s Medigap insurers are allowed to use medical underwriting when a person is applying outside of their Medigap initial enrollment period, and that applies to everyone under the age of 65 (since the Medigap initial enrollment period doesn’t begin until a person is at least 65).

The Department of Insurance noted that although KY Rev. Stat. § 304.17-311 has, for many years, required insurers to “make available upon request Medicare supplement insurance for persons not eligible for Medicare by reason of age,” this does not mean that the plans are guaranteed issue. “Make available” in this case just means that the insurer has to allow people to submit an application. But the application can be rejected if the person does not meet the insurer’s underwriting guidelines.

And if an applicant is approved for Medigap coverage under the age of 65, the prices are higher for those plans than they would be for a 65-year-old applicant. Again, all of this will change as of January 2024, due to H.B.345.

Enrollees can call the insurers directly, or reach out to the Kentucky State Health Insurance Assistance Program for assistance.

There are several states (Alaska, Iowa, Nebraska, North Dakota, South Carolina, Washington, and Wyoming) that don’t require private Medigap insurers to offer plans to people under 65, but that have maintained their pre-ACA high-risk pools in order to offer supplemental coverage to Medicare enrollees who are unable to obtain Medigap coverage. But Kentucky’s high-risk pool ceased operations in 2013.

Disabled Medicare beneficiaries under age 65 have the option to enroll in Medicare Advantage plans, which do cap out-of-pocket costs and cannot discriminate based on an enrollee’s age or health status. All Medicare beneficiaries are eligible for Medicare Advantage plans if the plans are available in their area (this now includes people with end-stage renal disease; prior to 2021, people with kidney failure could not join an Advantage plan unless there was an ESRD special needs plan available in their area).

What is Medicare Part D?

Original Medicare does not cover outpatient prescription drugs. But Medicare beneficiaries can get prescription coverage via a Medicare Advantage plan, an employer-sponsored plan (offered by a current or former employer), or a stand-alone Medicare Part D plan.

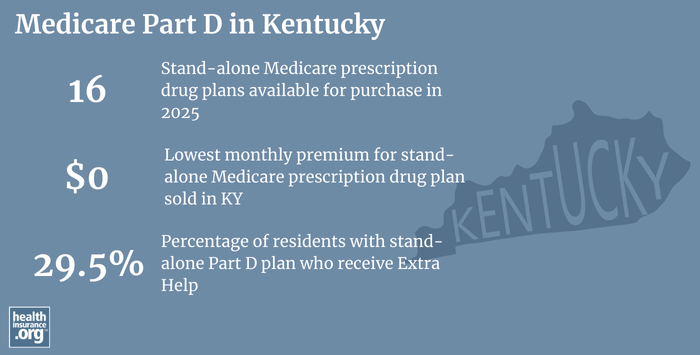

As of mid-2024, 352,298 beneficiaries of Medicare in Kentucky were enrolled in stand-alone Medicare Part D plans. Another 463,134 had Medicare Part D incorporated with their Medicare Advantage coverage, with the Advantage plan providing coverage for their prescription drugs.1 As Medicare Advantage enrollment has increased, enrollment in stand-alone Part D plans has decreased (overall Medicare enrollment has grown, but enrollment in Medicare Advantage plans is growing faster than total Medicare enrollment).

For 2025 coverage, there are 16 stand-alone Medicare Part D plans available in Kentucky, with premiums starting at $0 per month.6

Medicare’s annual open enrollment period in the fall (October 15 to December 7) is an opportunity for people to change their Part D coverage for the coming year. Medicare Part D enrollment selections made during this window take effect on January 1.

What additional resources are available for Medicare beneficiaries and their caregivers in Kentucky?

You can contact the Kentucky State Health Insurance Assistance Program for questions and information related to Medicare coverage in Kentucky, Medicare eligibility in Kentucky, or for help understanding your benefits or the process of filing for Medicare benefits.

The Kentucky Department of Insurance regulates and licenses the state’s health insurance companies and the brokers/agents who sell policies in Kentucky. They can answer questions, provide consumers with information and assistance, and address complaints about the entities they oversee.

This overview of how Kentucky Medicaid can help Medicare beneficiaries with low income and low asset levels is a useful resource for beneficiaries and their caregivers.

The Medicare Rights Center is a nationwide service, with a website and call center, that can provide assistance and information related to a variety of Medicare questions and scenarios.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.

Looking for more information about other options in your state?

Need help navigating health insurance options in Kentucky?

Explore more resources for options in KY including ACA coverage, short-term health insurance, dental and Medicaid.

Speak to a sales agent at a licensed insurance agency.

Footnotes

- “Medicare Monthly Enrollment – Kentucky.” Centers for Medicare & Medicaid Services Data. Accessed December, 2024. ⤶ ⤶ ⤶ ⤶ ⤶ ⤶ ⤶

- U.S. Census Bureau Quick Facts: United States & Kentucky.” U.S. Census Bureau, July 2023. ⤶

- “Medicare Monthly Enrollment – US” Centers for Medicare & Medicaid Services Data, Decemberr 2024. ⤶ ⤶

- ”Medicare Advantage 2024 Spotlight: First Look” KFF.org Nov. 15, 2023 ⤶

- ”The State of Medicare Supplement Coverage” AHIP. May 2024 ⤶

- ”Fact Sheet: Medicare Open Enrollment for 2025” (53) Centers for Medicare & Medicaid Services. Sep. 27, 2024 ⤶