Frequently-asked questions by tag

What type of health insurance exchange does my state have?

March 21, 2024 – As of the 2024 plan year, there will be 19 fully state-run health insurance marketplaces (SBMs), three state-based marketplaces that use…

Are smokers unable to afford insurance under the ACA?

February 26, 2024 – The surcharge is thought to impede access to health insurance for smokers in many states. But Medicaid and state-based regulations are…

How does the IRS calculate premium tax credits for self-employed people when their AGI depends on their health insurance premium amount?

February 12, 2024 – For self-employed Americans, premium amounts affect modified adjusted gross income, which in turn affects premium amounts. But the IRS has…

If your income last year was higher than expected, do you have to pay back some of the advance premium tax credits that you received for Marketplace coverage?

February 9, 2024 – If you received advance payments of the premium tax credit for health insurance that you purchased last year on HealthCare.gov (or a…

Does the Affordable Care Act make it easier to get individual health insurance?

January 11, 2024 – It's easier to get individual health insurance under the Affordable Care Act, but consumers in the individual market need to be aware that…

Do student health policies have to cover birth control without co-pays?

January 9, 2024 – Although schools with religious objections to contraception are not required to include contraceptive coverage in their student health…

Do student health care plans have to cover preventive care at no charge?

January 9, 2024 – Student health insurance plans must include preventive care and cannot impose any cost-sharing for recommended preventive…

Who ISN’T eligible for Obamacare’s premium subsidies?

January 3, 2024 – If your income is just a little over the subsidy-eligibility threshold, you can talk with a tax advisor about strategies for lowering your…

My employer offers insurance, but I think it’s too expensive. Can I apply for a subsidy to help me buy my own insurance?

September 11, 2023 – You cannot qualify for a health insurance premium subsidy unless the insurance your employer offers would force you to kick in more than…

Will my father’s premiums go up if I get coverage through his plan instead of my university’s plan?

July 31, 2023 – Young adults under 26 can get coverage through a parent’s plan even if their school (or their own employer) offers health insurance.…

We’re a family of four with an income of $50,000 a year. What kinds of subsidies are available to help us purchase insurance through the exchanges?

February 28, 2023 – The government offers two types of subsidies for people who buy their own insurance in the state’s marketplaces (a.k.a. health insurance…

I’m self-employed and am hiring employees. Under Obamacare, am I obligated to provide health insurance for them?

December 16, 2022 – No, unless you're hiring at least 50 full-time equivalent (FTE) employees. Businesses with fewer than 50 FTE employees (that's 96% of…

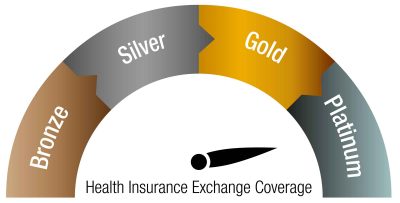

Can I purchase a Platinum policy and also get a premium subsidy?

July 12, 2022 – You can buy a Platinum plan and also get a premium subsidy. The size of the subsidy is based on the cost of a Silver plan, but you can…

If I decide to gamble and go without insurance, isn’t that my business?

August 18, 2021 – An individual's decision to "gamble" and go without health insurance can result in uncompensated care – a financial burden on hospitals…

My doctor posted a sign saying she ‘doesn’t take Obamacare.’ What should I do?

August 3, 2021 – It depends on your relationship with your doctor. If you're not particularly attached to her, it might be easier to just find someone new.…

My health insurance options from my employer are on an exchange. Is this part of Obamacare?

July 31, 2021 – If the health insurance options from your employer are on an exchange, it could be a private exchange – not the Affordable Care Act's…

If I get an Obamacare subsidy in the exchange, is the subsidy amount considered income?

July 26, 2021 – ACA health insurance subsidies (both premium assistance tax credits and cost-sharing reductions) are not considered income and are not…

I understand that subsidies come in the form of tax credits. But I’m unemployed and probably won’t owe any taxes. How would the subsidy help me?

June 7, 2021 – The premium subsidy offered through the exchanges is a tax credit, but it differs from some other tax credits in two important ways. First…

I work part-time. Am I eligible for a premium subsidy to help me buy insurance?

May 27, 2021 – Your eligibility for a premium subsidy isn't tied to how many hours you work. As long as you meet the income requirements for the premium…

Who is keeping track of whether I buy health insurance through the exchanges?

May 25, 2021 – Regardless of where you get your health insurance, you (and the IRS) will get a tax form from your employer, insurance company, or exchange…

If I have access to health insurance, can my husband’s company deny me coverage?

January 22, 2021 – The ACA requires employers with 50 or more workers to offer coverage to employees and their children (until age 26), but not a spouse. But…