Key takeaways

- Tap into the Affordable Care Act’s premium subsidies.

- Get cost-sharing reductions with a Silver plan.

- Don’t give up outside of open enrollment; you may have a qualifying event or be eligible for year-round enrollment.

- If your income is too high for subsidies, see if you can reduce your MAGI.

- Adjust your coverage to your family’s situation.

- Quit smoking to avoid a tobacco surcharge.

- Enroll in Medicaid or CHIP if you’re eligible.

- If ACA-compliant plans are unaffordable, consider non-compliant plans.

- Consider healthcare sharing ministries and direct primary care plan (but beware their limitations).

- Take advantage of medical and prescription discount plans.

It’s no secret that health insurance is – and always has been – expensive. The very fact that you’re reading this article suggests that you’re wondering whether health insurance can be affordable.

The answer is that affordable health coverage is out there and is possible – if you don’t overlook some obvious strategies that will decrease your insurance costs.

Health insurance is expensive …

First of all, expensive health insurance isn’t limited to the individual market.

Obamacare subsidy calculator *

Estimated annual subsidy

$0

Total annual premium cost for employer-sponsored coverage averaged $623/month for single employees in 2020. In the individual market, the average premium for plans purchased through the health insurance exchanges was $576/month. And those numbers are for single individuals — it’s a lot more expensive if you’re covering a family.

Why are Americans seemingly not as outraged about employer-sponsored (ESI) coverage costs? It’s because if you have employer-sponsored insurance, your employer likely pays a large chunk of your premiums. (The average employer pays $519/month of that $623/month total.) Not only that, but taxpayers chip in a hefty chunk of change to subsidize those with ESI.

… but it doesn’t have to be

Are people with ESI the only Americans who deserve subsidized coverage? The drafters of the Affordable Care Act (aka Obamacare) didn’t think so. So, while people in the individual health insurance market historically had to pay the full cost of coverage on their own, the Affordable Care Act changed that.

In fact, about 9.2 million people received premium tax credits (subsidies) to offset a significant portion of their premiums in the individual market in 2020. On average, their subsidies amounted to $491/month, covering the majority of their total premiums. (Throughout this article, we’ll use the terms “premium tax credit” and “premium subsidy” interchangeably, since they’re the same thing.)

And in places where health insurance is more expensive than average, the subsidies are larger than average too. For example, a family of four (parents age 45) in Rock Springs, Wyoming with an income of $97,000 will qualify for a premium subsidy of over $2,000 per month in 2021, and several of the available plans will be free after that subsidy is applied (ie, their full-price cost is less than the amount of the premium tax credit, so they end up having no premium at all).

There are examples like this in many states, although not all areas have super-low-cost Bronze plans. (It depends on how the cost of cost-sharing reductions (CSR) has been added to premiums, how many insurers offer coverage in a given area, and the way insurers have structured their product offerings.)

1. Subsidies deliver affordability

But the takeaway here is that your very obvious first step toward more affordable coverage should be to spend a few minutes checking to see how big your subsidy would be, and how much you’d have to pay in after-subsidy premiums for the various plans available in your area. You can calculate your subsidy here. Open enrollment for 2021 health coverage continues until at least December 15 nationwide, and there are several states where it will extend into January. If you’ve got questions about open enrollment, our comprehensive guide is a good place to start. After open enrollment ends, you can only enroll in an individual major medical plan if you experience a qualifying event.

If you’re eligible for a premium tax credit, selecting a metal-level plan in the exchange is the only way to get your tax credit. And from one year to the next, don’t rely on auto-renewal, as you might miss out on some amazing deals that weren’t available in prior years, due to the way pricing varies from one plan to another each year.

If you have off-exchange coverage, know that you may be one of the estimated 2.5 million people who could get premium subsidies if they simply bought an exchange plan. If you’re eligible for premium subsidies and buying off-exchange coverage, you could be leaving a considerable amount of money on the table, since subsidies are only available in the exchange. If you experience a qualifying event during the year, you’ll be able to switch to an exchange plan mid-year, and anyone can switch from off-exchange to on-exchange during open enrollment each fall, with coverage effective January 1.

2. Turbo-charge your premium subsidy

Are substantial premium subsidies the only way to reduce your health care costs? Again, thanks to the ACA, no.

If your household income (there’s an ACA-specific calculation for that) is less than 250 percent of the federal poverty level (FPL), you may be eligible for cost-sharing reductions (CSR), which reduce enrollees’ costs by lowering your maximum out-of-pocket exposure and by increasing your plan’s actuarial value.

(The Trump Administration announced in October 2017 that funding for CSR would end immediately, but the CSR benefits themselves are still available to eligible enrollees — nothing has changed about eligibility. And because the cost of CSR has been added to silver plan premiums in most areas, premium tax credits are also much larger than they were prior to 2018, making after-subsidy premiums more affordable for many enrollees.)

To receive CSR benefits, you must:

- Have a household income between 100 percent and 250 percent of the federal poverty level if you’re in a state that has not expanded Medicaid.

- Have a household income between 139 percent and 250 percent of the federal poverty level if you’re in a state that has expanded Medicaid.

- Select a Silver plan in your state’s exchange.

This chart shows the income levels that correspond to those ranges in any of the states where Medicaid has been expanded (the green, orange, and blue segments). Although CSR benefits extend up to 250 percent of the poverty level, they’re strongest for people with income under 200 percent of the poverty level. People with income between 200 and 250 percent of FPL sometimes find that they’re better off with a Bronze or Gold plan, despite being eligible for CSR benefits on Silver plans.

If you’re eligible for CSR benefits, you’ll want to pay particular attention to Silver plans in the exchange, despite the fact that they’ll cost more than the available Bronze plans. If you’re eligible for CSR benefits and you’re using HealthCare.gov, the Silver plans will be tagged with a little yellow banner that says “extra savings.” (State-run exchanges also have ways of designating that CSR benefits are included in the Silver plans, if you’re eligible.) If you work with a broker who is certified by the exchange, including healthinsurance.org’s trusted partners, he or she will be able to help you determine whether you’re eligible for CSR benefits and highlight the plans that include those benefits.

PRO TIP: If you’re eligible for cost-sharing reductions, do some math to determine whether you’ll be better off with a low-premium Bronze plan with high out-of-pocket costs, a Silver plan that comes with a higher premium but lower out-of-pocket costs (with built-in CSR benefits), or even a Gold plan that might have premiums and out-of-pocket costs that are similar to the Silver plans. (Remember that premiums have been very odd since 2018, with Gold plans sometimes priced lower than Silver plans). There’s no right answer here – it depends on your health, your risk tolerance, and your budget. And again, a broker who is certified by the exchange can help you make sense of all this and figure out what plan will best fit your needs and budget.

3. Don’t give up after open enrollment.

Open enrollment is the easiest and most obvious time to enroll in an individual market health plan. You won’t have to prove that you experienced a qualifying event, and there will be no requirement that you had coverage prior to enrolling in the new plan. But even after open enrollment ends, you may still be able to enroll. And if you’re eligible for a premium subsidy or CSR, you’ll be able to start receiving those benefit when you enroll.

- Read our guide to special enrollment periods.

- Learn about how coverage is available year-round to American Indians and Alaska Natives.

- Learn about the Basic Health Programs in Minnesota and New York, both of which can be purchased year-round, depending on the circumstances.

- Enrollment in Medicaid and CHIP are available year-round.

4. Run the numbers again.

Premium subsidy eligibility ranges are straightforward. (Premium subsidy eligibility extends to incomes up to 400 percent of the poverty level, and cost-sharing subsidy eligibility extends to incomes up to 250 percent of the poverty level. For a family of four in 2021, that’s $104,800 and $65,500, respectively; note that these amounts are based on the 2020 poverty level numbers, as the prior year’s numbers are always used to determine subsidy eligibility.)

But if it appears at first glance that your income is a bit too high (and you’re facing the subsidy cliff as a result) for you to be eligible for premium tax credits (or cost-sharing reductions), consider talking with a tax professional. There are several options for reducing your MAGI into the subsidy-eligible range, and they’re not as complicated as they might seem at first glance (MAGI stands for modified adjusted gross income; the calculation for it is specific to the ACA, and is different from general MAGI used for other purposes).

In general, contributions to a pre-tax retirement account will lower your MAGI, as will contributions to a health savings account (HSA). You can put money in a retirement account offered by your employer, or one that you establish on your own if you’re self-employed. Traditional IRA contributions also work to reduce MAGI, and depending on your income, you may be able to contribute to multiple retirement accounts. As long as you have HSA-qualified health insurance (ie, an HDHP), you can contribute to an HSA.

And if you’re self-employed, the health insurance premiums you pay (but not the part that’s covered by a premium subsidy) can be deducted from your income, leaving you with a lower MAGI that’s potentially subsidy-eligible.

What’s the difference? In some cases, the difference between getting subsidies and not getting subsidies can amount to tens of thousands of dollars per year.

5. Tailor your coverage to your situation

Shopping for health insurance should involve at least a little math, and there’s more to it than just comparing premiums. Here’s a rundown of the basics of comparing health plans.

There’s no single right answer, and plans vary considerably from one area to another. Your cousin might have scored a $2/month Bronze plan, but plans like that might not be available in your area, or you might find that a $200/month Gold plan ends up being a better option for you.

With that said, there are a few things to keep in mind when you’re considering your options:

- You don’t have to put all members of your family on the same plan. If only one family member is anticipating significant medical costs or needs to have access to a particular insurer’s drug formulary and/or provider network, splitting the family onto two different plans might be the best solution (and the exchange can do this for you, with your premium subsidy applied). Keep in mind that your total family out-of-pocket exposure will be higher this way, since the family out-of-pocket maximum only applies to family members on one plan.

- If you’re anticipating very high medical costs (ie, you’re going to hit the maximum out-of-pocket on any plan), a Bronze plan with low premiums might actually end up being a better deal – in terms of total premiums plus total out-of-pocket costs – than a more robust (and more expensive) plan.

- If you want to contribute money to an HSA in order to reduce your modified adjusted gross income (MAGI) and qualify for premium subsidies, you’ll want to focus on HSA-qualified high-deductible health plans. There may only be one or two available in your area, but almost all parts of the country do have at least on HDHP available. (You may have to look in the plan details to tell for sure, but these plans often have HSA as part of their name).

6. Still smoke? Here’s a huge reason to quit.

Under the ACA, health insurance companies are no longer allowed to adjust enrollees’ premiums based on their medical history. But tobacco use is the one exception. Insurance companies can charge smokers up to 50 percent more than non-smokers (some states have set a lower limit), and premium subsidies are based on the cost of coverage for non-smoker, so smokers have to pay the surcharge themselves, even if they qualify for premium subsidies.

The tobacco surcharge in the ACA is controversial, and may actually be counterproductive. But for better or worse, it’s part of the current legal structure. If you smoke, know that tobacco cessation intervention is one of the preventive care services covered at no cost on all ACA-compliant plans. And if you quit, you’ll end up with lower insurance rates.

7. Enroll in Medicaid or CHIP if you’re eligible

Expansion of Medicaid was a cornerstone of the ACA’s provisions for reducing the uninsured rate in the United State – and it’s worked remarkably well in the states that accepted federal funding to expand coverage. Since late 2013, enrollment in Medicaid and CHIP has grown by more than 19 million people, many of whom became eligible thanks to the ACA’s expansion of coverage.

There are still 14 states that have not expanded Medicaid. But if you’re in a state that has expanded coverage, you can get free or very low-cost coverage if your income doesn’t exceed 138 percent of the poverty level. (For a single individual, that’s currently $17,608; for a family of four, it’s $36,156.)

CHIP (Children’s Health Insurance Program) coverage is available to kids whose household income can be quite a bit higher than the Medicaid eligibility cut off, and the Medicaid cutoff itself is higher for kids than it is for adults. So you might find that your kids can qualify for very low-cost coverage even if your income is too high for Medicaid. It’s quite common for parents to qualify for premium subsidies in the exchange while their kids qualify for Medicaid or CHIP instead. If your kids are eligible for Medicaid or CHIP, the exchange will sort that out for you when you apply for coverage.

8. Short-term plans and other non-ACA-compliant plans

If there is no way that you’ll qualify for premium subsidies and you’ve determined that all of the plans available in your area are unaffordable, a plan that isn’t ACA-compliant is a better option than going uninsured altogether.

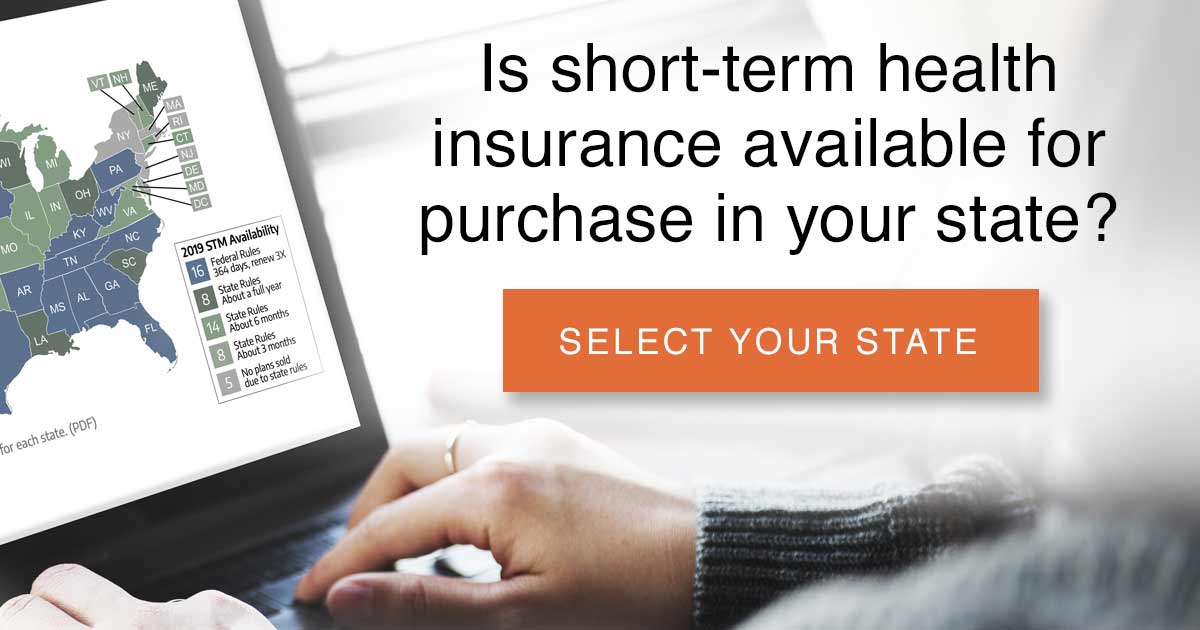

Depending on where you live, you may be able to purchase a short-term plan with a term limit of up to 364 days, and it may be renewable for a total duration of up to three years. You may also be able to purchase a bundled product that combines a short-term plan with a fixed-indemnity plan. Accident supplements and critical illness plans are also available, although they’re designed to supplement other coverage rather than serve as stand-alone coverage.

Depending on where you live, you may be able to purchase a short-term plan with a term limit of up to 364 days, and it may be renewable for a total duration of up to three years. You may also be able to purchase a bundled product that combines a short-term plan with a fixed-indemnity plan. Accident supplements and critical illness plans are also available, although they’re designed to supplement other coverage rather than serve as stand-alone coverage.

A plan purchased in the non-ACA-compliant market are not considered minimum essential coverage, and will not fulfill the individual mandates that exist in DC, New Jersey, Massachusetts, Rhode Island, and California. But there is no longer a federal penalty for being without minimum essential coverage.

It’s important to understand the drawbacks of short-term health plans, which are numerous. But if your other alternative is to go without coverage altogether, a short-term plan is certainly better than nothing.

There are other non-ACA-compliant health plans available in some areas, including Farm Bureau plans in some states. Regardless of the type of coverage you’re considering, you’ll want to carefully read all of the fine print — and that’s especially true if you’re looking at a plan that’s not compliant with the ACA.

9. Health care sharing ministries and direct primary care plans

Health care sharing ministries are another option that appeal to some people who can’t afford ACA-compliant coverage. Sharing ministry coverage is not considered health insurance, and is not regulated by state insurance commissioners (the majority of the states explicitly exempt sharing ministry plans from state insurance laws and regulations).

If you opt to join a health care sharing ministry, your mileage may vary. Some people love them, and others find themselves counting down the days until the next open enrollment so that they can switch back to an ACA-compliant plan. Be sure to read all the fine print, and make sure that the sharing ministry’s lifestyle requirement actually match your lifestyle. There is no doubt that ACA-compliant coverage is a more solid safety net than a health care sharing ministry. But if your plan is to go without any coverage at all, a sharing ministry is a better option.

Some people opt to combine a health care sharing ministry plan with a direct primary care plan. Again, your mileage may vary. You need to be aware that the majority of the states have also exempted direct primary care arrangements from insurance laws and oversight. So if you’re relying on a combination of two plans that are both exempt from state and federal insurance laws, your state’s insurance department will not be able to intervene on your behalf if you run into problems. And the fact that the plans are not considered insurance means that they are not subject to a contractual obligation to pay claims. Again, read the fine print and make sure you understand what you’re getting — and not getting — when you sign up for these plans.

10. Discount plans

Medical and prescription discount plans are another possibility, but they should be seen as a last resort, and should not be mistaken for adequate stand-alone coverage. They may be beneficial when combined with something like a fixed-indemnity plan, but again, your mileage will vary.

The discounts aren’t guaranteed, and tend to be more substantial for lower-cost services. You’ll get a discount when you use medical providers who participate in the program, but your out-of-pocket exposure won’t be capped, and will be considerable if you end up needing extensive medical care.

Final tips

If you’ve read through these tips and you’re still not certain you can find affordable coverage, it’s always a good idea to consult a trustworthy broker who can help you wade through the available options. Clarify whether the plans they’re presenting to you are ACA-compliant or non-compliant, or a mixture of both.

And as always, before you sign on, read the fine print. Ask about drug formularies and provider networks if that’s important to you.

Don’t go uninsured. You’re not invincible, and while health coverage is expensive, health care is really expensive.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.