Short-term health insurance

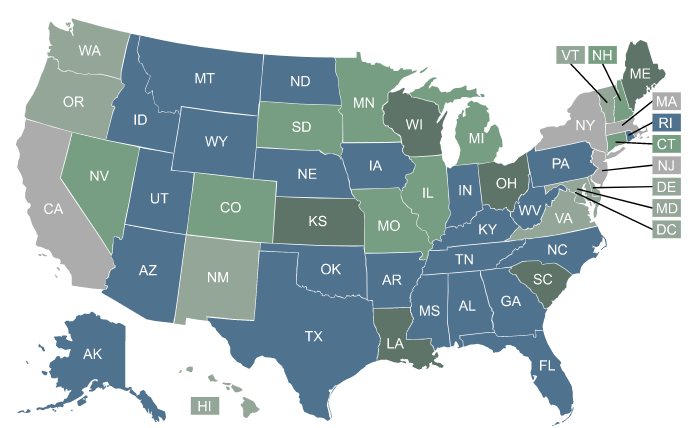

Regulation of short-term health insurance coverage varies by state. In 14 states and the District of Columbia, temporary health plans aren’t available for purchase at all.

Short-term health insurance availability and limits by state

Click your state for details

What is short-term health insurance?

Short-term health insurance offers temporary coverage to fill a gap between other health plans. Short-term health insurance is not comprehensive coverage and is not regulated by the Affordable Care Act, federal mental health parity rules,1 No Surprises Act,2 or other federal health insurance rules.

Short-term health insurance is not an excepted benefit under the ACA.3 But it is exempt from federal insurance rules and regulations specifically because it is not considered individual health insurance.4

Explore short-term health insurance options.

Get a free quote from a third-party insurance agency!

Who might consider short-term coverage?

These plans can be attractive to people who are facing a gap between other health insurance policies, without an option to enroll in ACA-compliant coverage during that time. This includes people who are between jobs, or those who have already enrolled in other insurance coverage (an employer’s plan or an ACA-compliant individual market plan, for example) and are waiting for it to take effect.

A short-term health plan can also bridge a gap in coverage if you’re newly employed and have a waiting period of up to three months before you’re eligible to enroll in your employer’s health benefits plan.

Frequently asked questions about short-term health insurance

Why would I buy a short-term plan – and not an ACA-compliant plan?

If you’re facing a gap in coverage, you might have an option to enroll in an ACA-compliant plan. But this will depend on whether you qualify for a special enrollment period, and your ability to afford an ACA-compliant plan might also depend on whether you qualify for a premium subsidy in the Marketplace.

There are currently almost 1.5 million people caught in the coverage gap in nine states that have not expanded Medicaid.5 Their household incomes are under the federal poverty level, so paying full price for health insurance may not be a realistic option.

The American Rescue Plan and Inflation Reduction Act have temporarily eliminated the subsidy cliff through 2025, meaning that households with income over 400% of the poverty level can qualify for a premium subsidy if the cost of the benchmark plan would otherwise be more than 8.5% of the household’s income.

And the IRS partially fixed the family glitch as of 2023, so some families are newly eligible for subsidies in the Marketplace when their offer of coverage from a family member’s employer is not considered affordable (although the employee is still ineligible for Marketplace subsidies assuming their own employer-sponsored coverage is considered affordable, meaning that the family’s total premiums could still be outside their budget).

But the coverage gap continues to be a problem in the states that have not expanded Medicaid. And subsidies are also not available to undocumented immigrants, who aren’t allowed to purchase coverage through the exchange even if they’re willing to pay full price.

And if you missed open enrollment (either for your employer’s plan or for a private individual/family plan) and aren’t eligible for a special enrollment period in the individual market, you likely cannot enroll in ACA-compliant major medical coverage until the following year, unless you’re eligible for Medicaid.

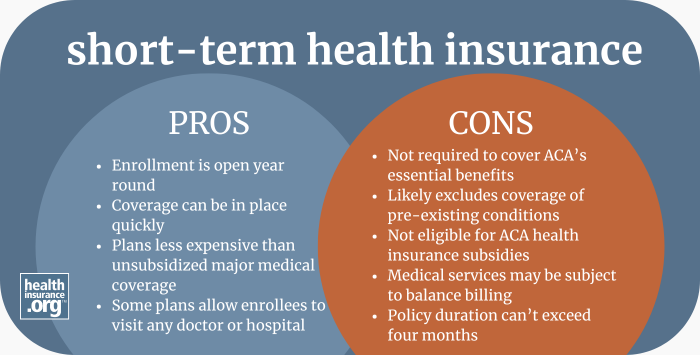

If you’re among these consumers who don’t have access to affordable ACA-compliant coverage, it’s worth at least weighing the pros and cons of short-term coverage – keeping in mind that these plans can only serve as a short-term solution.

Do short-term plans cover ACA's essential benefits?

Under federal rules, short-term plans are not required to cover the ACA’s essential health benefits. So in most states where short-term health plans are available, the available plans tend to have more benefit limitations than ACA-compliant plans, and gaps in their coverage for at least some of the essential health benefit categories.

The most commonly excluded categories of coverage are maternity care, mental health care, preventive care, and prescription drugs,6 although short-term plans can be designed to include or exclude whatever services they choose, unless states require certain mandated benefits to be covered. (Click on your state on the map above to see our guides about plan availability and information about how short-term health insurance is regulated.)

Most short-term plans will provide at least some coverage for medically necessary inpatient and outpatient medical care, including emergency services. But there are generally blanket exclusions for any pre-existing condition that the enrollee may have, and the plans will often impose limits on the amount the plan will pay for certain services.

How long will a short-term health plan cover me?

For short-term policies sold or issued on or after Sept. 1, 2024, the total maximum policy duration is four months, including renewals. Some carriers may choose to only offer a three-month policy, with no renewal option, and there are some states that prohibit short-term policy renewals. There are also some states where there are no short-term policies available (details below).

If you enrolled in a short-term policy prior to Sept. 1, 2024, it could have a total duration of up to three years, including renewals. This will depend on where you live and the specific policy you purchased.

Who is eligible to purchase short-term health insurance?

As long as you can pass the medical underwriting involved in most short-term health plan applications (typically a short series of yes/no questions about major medical events), you can purchase a short-term plan.

But be aware that the plan will likely exclude any pre-existing medical condition, even if it’s not mentioned in the list of health questions asked on the application. And short-term health insurance often uses post-claims underwriting, which means the insurer can go back through your medical records if and when you have a claim.7

They can use that information to determine whether the claim is related to a pre-existing condition (and thus not covered), and can also rescind the coverage altogether if they find information indicating that the applicant wasn’t truthful on the initial application.

How do consumers buy short-term health insurance coverage?

Short-term health insurance is typically purchased online, although paper applications and in-person enrollments are available in some cases. Short-term health insurance can be obtained via a website that offers numerous plan options from multiple companies, or directly from an insurance company that sells short-term plans.

Short-term health plans are offered by several national companies that sell plans in numerous states, as well as regional companies that have more localized service areas, so short-term plan availability varies considerably depending on where you live.

Short-term health insurance plans are available in most states, but in 2025, there are 15 states (including DC) where no short-term plans are available, due to either outright bans or state laws that make offering short-term health plans unattractive to insurers.

When can I enroll in a short-term health plan?

Enrollment in short-term health plans is available year-round, albeit with medical underwriting. So you can enroll or change plans anytime you like, without having to wait for an open enrollment period.

(Note that some states prohibit enrollment in short-term health plans during the open enrollment period for ACA-complaint coverage. Maine8 and Washington9 are examples of this, but no insurers offer short-term health plans in either of those states as of 2025.)

How long will it take me to get short-term coverage?

With short-term policies, applicants who are younger than 65 and who don’t have any of the medical conditions that would result in a declined application can secure immediate individual and family coverage, with plans that can take effect as early as the next day.10 If you already know the number of days you will need to be covered, your insurer may allow you to make a single payment for the whole coverage period.

The application process for short-term health insurance is typically quite simple, with just a handful of yes/no questions about medical history. As long as your truthful answer to all of the questions is “no,” you’ll generally be accepted for coverage with an effective date as soon as the following day.

(It’s important to understand that short-term healthcare plans generally rely on post-claims underwriting, which means the insurer will go back and take a closer look at your medical history if and when you experience an injury or illness that results in a medical claim, to ensure that the condition was not pre-existing.)

How much does short-term health insurance cost?

The monthly premiums for short-term health insurance vary considerably depending on where you live, your age, and the insurance company that’s offering the coverage. Depending on the circumstances, they can start at under $100/month.

Although premium subsidies are not available for short-term policies, the plans do tend to be considerably less expensive than ACA-compliant major medical plans if you’re not eligible for a premium subsidy. The trade-off is that they don’t provide as much coverage as an ACA-compliant plan, won’t cover pre-existing conditions, and can reject your application based on your medical history.

With that said, however, many people are eligible for premium subsidies to purchase coverage through the exchange, assuming they’re not eligible for Medicare, Medicaid, or an employer’s health plan (93% of Marketplace enrollees were receiving premium subsidies as of early 202411). And opting for short-term coverage would mean that you’d give up your opportunity to receive a premium subsidy.

How do short-term health insurance premiums compare to ACA-compliant plan premiums?

A lower monthly premium is the primary draw for short-term plans. Consider a single 45-year-old, living in southwestern Wyoming and earning an income of $15,000 in 2025. (There’s an ACA-specific calculation for household income; it’s a form of modified adjusted gross income, but it differs from MAGI calculations used for other purposes).

That’s under the 2024 federal poverty level, which is used to determine eligibility for 2025 subsidies. And Wyoming has not accepted federal funding to expand Medicaid. That means this person is ineligible for Medicaid, and they’re also ineligible for premium subsidies in the exchange/Marketplace. In other words, they’re in the coverage gap that Wyoming has created by refusing to expand Medicaid.

The least expensive ACA-compliant plan available to this person will cost $755/month.12 That’s likely unrealistic with an income of only $1,250 a month.

But if we look at short-term plans, there are policies available with premiums starting at under $150/month, and numerous plans available with premiums below $300/month. That could still be a stretch for someone earning $15,000/year, but it’s much more feasible than $755/month.

The deductible for the lowest-priced short-term plans will be in the range of $10,000 (versus $7,000 for the least-expensive ACA-compliant plan in the area), and the out-of-pocket maximum will be $20,000 (versus $8,300 for the cheapest ACA-compliant plan available to this person; the upper limit on out-of-pocket costs for any ACA-compliant plan is $9,200 in 2025).13

The available short-term plans all have a maximum total duration of four months, including renewals under federal rules. There are several plan designs available, and although none of them provide comprehensive benefits as is the case under ACA-compliant plans, the trade-off is that they have lower premiums.

(It should be noted that if this person had an income of $16,000, instead of $15,000, they would be eligible for a premium subsidy of $997 per month, which would allow them to choose from numerous premium-free ACA-compliant plans in the Wyoming exchange. None of the available plans would cost more than about $53/month, even for the most comprehensive options. This is why it’s so important to understand the income thresholds for subsidy eligibility in the exchange.)

What does short-term health insurance cover?

Short-term health insurance policies are designed to cover at least some of the cost of unexpected medical events that are not linked to a pre-existing condition. The plans will generally provide coverage for inpatient and emergency care, surgeries, and various outpatient services, lab work, and imaging.

Some short-term plans include inpatient prescription drugs, although it’s much less common for short-term plans to cover prescriptions that you’d pick up at the pharmacy.

Can I buy short-term insurance in my state?

Though short-term plans are available in most states, short-term plans aren’t available at all in 14 states and DC.

Find out more in our guides below about states where you can’t buy short-term health plans in 2025:

- California

- Colorado

- Connecticut

- District of Columbia

- Hawaii

- Illinois (new to this list as of 2025)14

- Maine

- Massachusetts

- Minnesota

- New York

- New Jersey

- New Mexico

- Rhode Island

- Vermont

- Washington

In some cases, this is because state regulations ban them outright, while in other cases it’s because state regulations are strict enough that insurers have opted not to sell short-term plans. And the availability of short-term plans does sometimes fluctuate from one year to the next in a given state, due to insurer business practices and evolving state regulations. So the list of states that don’t offer short-term health insurance may change over time.

Short-term plans are available in the remaining states, but regulations and availability vary considerably from state to state. (Choose your state from the map above to see our guides about how short-term plans are regulated within your state.)

Will short-term plans cover my doctors?

Short-term health insurance plans generally cover a range of physician services, surgery, outpatient and inpatient care. In addition, policyholders can sometimes choose their own doctor and hospital without restrictions, though there may be a benefit for using in-network providers instead of doctors that are out of network.

If the short-term plan has a provider network and the patient stays in-network, the provider’s total payment will be adjusted to match the insurer’s approved reimbursement rate (the cost will be split between the health plan and the policyholder according to the terms of the plan).

But if the health plan does not have a provider network – often touted as a benefit that provides freedom to see any doctor – enrollees should be aware of how balance billing works. This is described in more detail below.

Does short-term health insurance cover pre-existing conditions?

Even if you’re eligible for coverage based on the short list of questions asked on the application, you will generally not have coverage for any pre-existing medical conditions while you’re enrolled in the plan. Short-term plans are designed to provide coverage for medical conditions that have not yet arisen – and will generally not be of any use for medical conditions you already have.

Be sure to check the list of exclusions on any policy. Short-term plans also tend to use post-claims underwriting, which means they can go back through your medical history if and when you have a claim, to verify if you had any pre-existing conditions at the time of your enrollment.

What are possible drawbacks of short-term health plans?

What are some of the factors that might make consumers reluctant to buy short-term coverage?

You may be subject to balance billing

Some short-term plans tout the fact that you can see any doctor or go to any hospital you want. While that might sound good, it’s also a red flag for potential balance billing. If the plan doesn’t have a provider network, that means the doctors and hospitals that members end up using have not agreed to accept the insurer’s reimbursement rates as payment in full.

In that case, whatever amount the insurer pays them (a “reasonable and customary” amount, a percentage of Medicare rates, etc.) is likely to be less than what they billed. And since they do not have a contract with the short-term insurer, they are free to send a bill to the patient for whatever amount the insurance plan doesn’t pay.

So even if the plan has a maximum out-of-pocket limit, enrollees should keep in mind that balance billing could potentially result in much higher out-of-pocket costs if the plan doesn’t limit care to a specific network of providers.

You could still end up facing a gap in coverage.

When your short-term plan ends, you will not be eligible to purchase a regular plan in the individual market if it’s outside of open enrollment. Loss of minimum essential coverage is a qualifying life event that triggers a special enrollment period, but a short-term plan is not considered minimum essential coverage so you won’t be eligible for a special enrollment period when the plan terminates.

But if you’re buying short-term coverage to get you through to the end of the year, you’ll be able to purchase an ACA-compliant plan during open enrollment that will take effect the first of the coming year. And if you’re going to be starting a new job that offers health insurance, you’ll be able to enroll in your new employer’s plan as soon as you’re eligible.

(It’s worth noting that the termination of a short-term plan does trigger a special enrollment period for an employer’s group health coverage. (See page 51 of the 2018 rule for short-term plans). So if you have access to your employer’s plan but hadn’t enrolled – and had enrolled in a short-term plan instead – the termination of your short-term plan would allow you a special enrollment period during which you could enroll in your employer’s plan.)

Now that short-term health plans cannot have total durations longer than four months, including renewals, under the new federal rules, it’s important to plan ahead for the coming plan year.

If you purchased a short-term policy that was issued before Sept. 1, 2024 and it will expire at some point in 2025, keep in mind that the new plans available after expiration will be limited to shorter terms.

And the termination of your short-term policy will not allow you to purchase an ACA-compliant plan at that point, so you might end up being uninsured until the start of the following year unless you qualify for a special enrollment period (you would be able to sign up during the next open enrollment period, but your soonest available effective date would be January 1 of the following year).

To ensure that you’ll have uninterrupted coverage for the whole year, you can enroll during the open enrollment period (Nov. 1 to Jan. 15 in most states) to purchase an ACA-compliant plan. As long as you enroll through the Marketplace in your state, you can also see if you are eligible for income-based premium and cost-sharing subsidies. Most Marketplace enrollees qualify for premium subsidies, and about half receive cost-sharing subsidies.11.

Are temporary health plans regulated by the ACA?

No, short-term health plans are not regulated by the ACA. Although the ACA has largely done away with medical underwriting for major medical health insurance plans, short-term plans can still ask some basic medical history questions in order to determine an applicant’s eligibility for coverage, because short-term plans are not subject to the ACA’s regulations.

And post-claims underwriting is widely used for short-term health plans. But that also means that short-term policies are available year-round, which is not the case for ACA-compliant individual major medical plans.

Do short-term plans have benefit maximums?

Yes. Since short-term plans are not regulated by the ACA, they can have annual and lifetime benefit maximums.

Is loss of my short-term coverage a qualifying event?

Short-term health insurance policies are not considered minimum essential coverage under the ACA, which means that the termination of a short-term policy is not a qualifying life event that triggers a special enrollment period for an ACA-compliant individual market plan.

As noted above, however, the termination of a short-term health plan does trigger a special enrollment period that will allow a person to enroll in an employer’s group health plan, if one is available to the person.

Footnotes

- “The Mental Health Parity and Addiction Equity Act (MHPAEA)” CMS.gov. Accessed June 26, 2024 ⤶

- “Ending Surprise Medical Bills” CMS.gov. Accessed June 26, 2024 ⤶

- “§ 148.220 Excepted benefits”ecfr.gov. Accessed June 26, 2024 ⤶

- “Excepted Benefits; Lifetime and Annual Limits; and Short-Term, Limited-Duration Insurance” Section II(A). Federal Register. Oct. 31, 2016 ⤶

- “How Many Uninsured Are in the Coverage Gap and How Many Could be Eligible if All States Adopted the Medicaid Expansion?” KFF. Feb. 26, 2024. ⤶

- “ACA Open Enrollment: For Consumers Considering Short-Term Policies” KFF. Oct. 25, 2019. ⤶

- “Short-Term, Limited-Duration Insurance and Independent, Noncoordinated Excepted Benefits Coverage” Internal Revenue Service; Employee Benefits Security Administration; Health and Human Services Department. April 3, 2024 ⤶

- “Bulletin 438 Short-Term, Limited-Duration Policies and Limited Benefit Policies” Maine Bureau of Insurance. Oct. 10, 2019 ⤶

- “What you need to know about short-term medical plans” Washington Office of the Insurance Commissioner. Accessed May 6, 2025 ⤶

- “ACA Open Enrollment: For Consumers Considering Short-Term Policies” KFF.org. Oct. 25, 2019 ⤶

- “Effectuated Enrollment: Early 2024 Snapshot and Full Year 2023 Average” CMS.gov, July 2, 2024 ⤶ ⤶

- “See Plans & Prices” (zip code 82901) HealthCare.gov. Accessed Feb. 7, 2025 ⤶

- “Out-of-pocket maximum/limit” HealthCare.gov. Accessed Nov. 1, 2024 ⤶

- “Illinois HB2499” BillTrack50. Signed into law July 10, 2024 ⤶