How and when you can enroll in Medicare

Medicare’s annual open enrollment period is October 15 – December 7. But there are other opportunities to change your coverage during the year.

Key takeaways

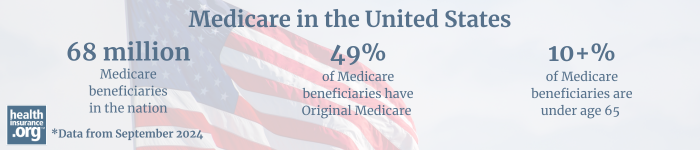

- 68 million Americans are enrolled in Medicare.

- Check Medicare availability in your state

- Your eligibility depends on your age, but also other variables.

- When you can enroll in Medicare coverage

- Frequently asked questions about Medicare

68 million Americans are enrolled in Medicare

Medicare is the federal health insurance program created to provide a safety net for people age 65 and older, as well as disabled enrollees who meet specific criteria. The Centers for Medicare and Medicaid Services reports that roughly 68 million Americans were enrolled in Medicare as of September 2024.1

All of these people have an opportunity to make various changes to their coverage during the annual fall enrollment period (October 15 through December 7). And the 34 million beneficiaries who have Medicare Advantage plans can make a change to their coverage during the Medicare Advantage Open Enrollment Period, which runs from January through March.

Medicare availability in your state

Click your state for details

Learn about Medicare plan options by contacting a licensed agent.

Eligibility depends on your age, other variables

For the vast majority of Americans who look forward to receiving Medicare health benefits, eligibility is as uncomplicated as celebrating your 65th birthday. But eligibility isn’t dependent solely on your age; more 10% of all Medicare beneficiaries are under age 65, and are eligible for Medicare due to a long-term disability.1 Here’s more about Medicare eligibility:

Frequently asked questions about Medicare

When can you enroll in Medicare?

Millions of Americans have been automatically enrolled in Medicare Part A and Part B at age 65. Others have an enrollment window during which they can sign up for Medicare when they’re turning 65, and still others gain eligibility for Medicare due to a disability or diagnosis of ALS or end-stage renal disease. It’s important to know Medicare open enrollment dates for initial enrollment and beyond.

| A quick look at Medicare enrollment dates | |

|---|---|

| October 15 – December 7 |

Medicare’s annual open enrollment (AEP) |

| December 8 – November 30 |

You may be able to switch to a new Advantage or Part D plan if there’s a 5-star plan in your area. |

| January 1 – March 31 |

You can sign up for Medicare Part B (and premium Part A, if applicable) if you didn’t sign up when you were first eligible. |

| January 1 – March 31 |

An opportunity for people already enrolled in a Medicare Advantage plan to switch to a different Medicare Advantage plan or to Original Medicare. |

| Any time | You can apply for Medigap at any time, but in most states, your application will be subject to medical underwriting if you’re not in your initial six-month eligibility window, or your trial right period during the first 12 months of having a Medicare Advantage plan. |

Can you can change your Medicare coverage?

The annual Medicare open enrollment period (October 15 through December 7) is just one of a handful of opportunities to swap out your Medicare plan.

What Medicare coverage options do I have?

Medicare includes:

- Part A (inpatient coverage)

- Part B (outpatient and physician services)

- Part C (Medicare Advantage, which incorporates Part A and Part B into a private plan, usually with Part D coverage as well)

- Part D (prescription coverage).

- There are also Medigap plans available in every state, which can be used in conjunction with Medicare Part A and Part B.

Deciding which Medicare coverage is right for you is not as easy as a multiple-choice question with a single right answer. Here’s an overview of your Medicare plan options and other helpful articles:

What is the cost of Medicare coverage?

Your eligibility to receive Medicare Part A coverage without having to pay a premium – and your eligibility for other Medicare plans – depends on such factors as your work history and age. And depending on when you enroll in a Medigap plan, your health status.

Footnotes

- ”Medicare Monthly Enrollment, September 2024” Centers for Medicare & Medicaid Services. Accessed Feb. 12, 2025 ⤶ ⤶